Al enige tijd houden wij de site www.swingstocktraders.com in het oog. Wij zijn tot de conclusie gekomen dat je met de tips een zeer goede winst kunt maken. De methode is wel arbeidsintensief, maar als je hart ligt bij Swingtrade is het erg leuk om mee te doen. Wij hebben nu vanaf 1 januari 2013 een abonnement voor €150 per jaar genomen. Het abonnement is erg goedkoop te noemen , vooral omdat wij in de eerste week al een winst hadden van ruim €700.

Iedere dag ontvang je enkele aankooptips via de email! Wij hebben deze berichten gekoppeld aan Boxcar, dat is een app voor de Iphone of Android. Zodra er live een email binnenkomt krijg je dan een bericht op je telefoon. Zo hoeft je niet heel de tijd achter de PC te zitten. Er zijn natuurlijk nog veel meer mogelijkheden, zoals email op je smartphone enz.

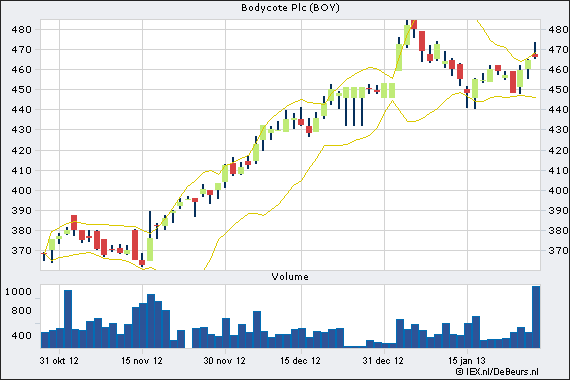

Op de site vind je de aandelen waarnaar wordt gekeken die dag en deze worden live bijgehouden. Uit deze aandelen ontvang je dan later een bericht dat zij deze hebben gekocht. Je hebt dus genoeg tijd om de aandelen te selecteren en in te stellen op je platform.

Wij zijn begonnen met een start bedrag van €20.000 en wij hebben op dit moment een winst van 60%. (€12.000).

Het belangrijkste is dat je goed gebruik maakt van de stoploss methode die ze uitleggen op de site. Niet een harde stop, maar een mentale stop.

Soms zakt een aandeel tijdens de dag onder de stoploss, maar hij sluit weer 1% er boven! Vaak kan je dan de volgende je winst alsnog pakken.

Het is even trainen, maar daarna is het erg leuk. Meer als de rente op je spaar geld heb je in 100% van de gevallen!!

De methode zorgt ervoor dat je niet meer mee doet met wat denk jij voor morgen AEX, ik denk dat?( Maar waarom kan je niet vertellen) Dat is vanaf nu anders! Je werkt eenvoudig met een plan en dat is emotieloos en daarom leuk en winstgevend!

De site is Engels, maar er zijn enkele medewerkers die spreken ook Nederlands. Ook de betaling gaat veilig via Paypal. Dit kan gewoon met je bankrekening van ING! Nu ik dit weet vind ik het veel veiliger dan Ideaal.

Mocht je nieuwsgierig zijn geworden kijk dan even op de site. http://www.swingstocktraders.com

You must be logged in to post a comment.